INVESTMENT FRAMEWORK

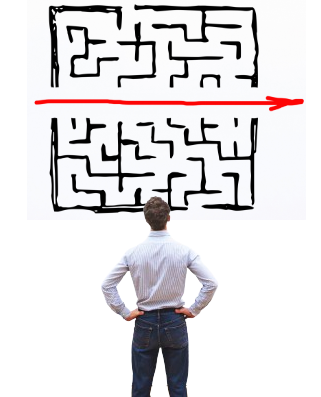

Empowering smarter

investment choices

Global Expertise, Local Impact

At Lumiq Wealth, our investment framework integrates decades of managing trillions of USD globally, directly influencing the portfolios of Indian investors. We leverage this extensive experience to craft strategies aligned with the unique needs of each investor.

Strategic Decades-Long Approach: Rooted in a strategic, long-term perspective, our investment philosophy recognizes that sustainable wealth creation demands discipline and patience. This principle is diligently applied to every investment decision, ensuring enduring value for our clients.

Three-Step Methodology

Risk Profiling Assessment

Lumiq Wealth commences the investment journey with a meticulous risk profiling assessment. This process ensures a deep understanding of each investor’s risk tolerance and financial goals, facilitating alignment with a bespoke model portfolio.

Market Temperature Gauge

Serving as a “temperature gauge” for the market, our platform dynamically assesses trends, aiding in the determination of optimal weights across different asset classes within the model portfolio. This ensures a responsive and adaptive investment strategy.

Quantification of Portfolio

Our investment framework quantifies portfolios from an investable universe of 5000+ Mutual Fund schemes. Each scheme undergoes a rigorous ranking process, utilizing our proprietary forward-looking return methodology. This internal ranking optimizes for risk-adjusted returns, ensuring a balanced and well-considered selection.

Model Portfolios

Each investor based on risk profiling outcome is categorized in one of 5 model portfolios

Ultra Aggressive

Strategically designed for high growth potential, catering to investors comfortable with substantial market volatility and seeking maximum returns.

Aggressive

Balancing growth with a managed risk approach, this portfolio suits investors with a high-risk tolerance, aiming for substantial returns.

Balanced

Offering a mix of equities and fixed-income instruments, the Balanced portfolio suits those seeking a moderate-risk approach with steady, long-term returns.

Conservative

Prioritizing capital preservation, this portfolio is designed for risk-averse investors, minimizing volatility with a focus on stability.

Ultra Conservative

Tailored for capital protection and income generation, this portfolio is for extremely risk-averse investors, emphasizing stability and regular income.

Vigilant Tracking and Adaptability

Experience the Lumiq difference — where your financial success is our priority.

Our investment framework seamlessly integrates technology, risk assessment, market intelligence, and quantitative analysis, offering a holistic approach to investments. Lumiq Wealth is dedicated to providing personalized, dynamic, and forward-looking investment solutions to help our clients achieve their financial objectives.

Still have question?

We’re here to help

Didn’t find what you were looking for? Let’s Schedule an appointment